What are high deductible health plans and what is their relationship to health savings accounts?

High Deductible Health Plans (HDHPs) are health plans that have higher deductibles but offer lower premiums than traditional plans. HDHPs do not have what is referred to as “first dollar coverage”, or co-pays. Due to out of pocket obligation, a qualified HDHP can be combined with a health savings bank account (HSA), allowing you to pay for qualified healthcare expenses with money free from taxes.

Employees may fund an HSA with pre-tax dollars in order to pay for qualified healthcare expenses, up to the designated IRS limits shown in the chart below. Qualified expenses include medical, dental, vision and hearing expenses. The HSA bank account is the employee’s own. The funds in the accounts roll over from year to year, but the account can only be contributed to when an employee is enrolled in a qualified HDHP. After age 65, this account can be used as an additional retirement account.

IRS Defined Limits for HSAs:

How do HDHPs and HSAs affect the cost of my employer sponsored health plan?

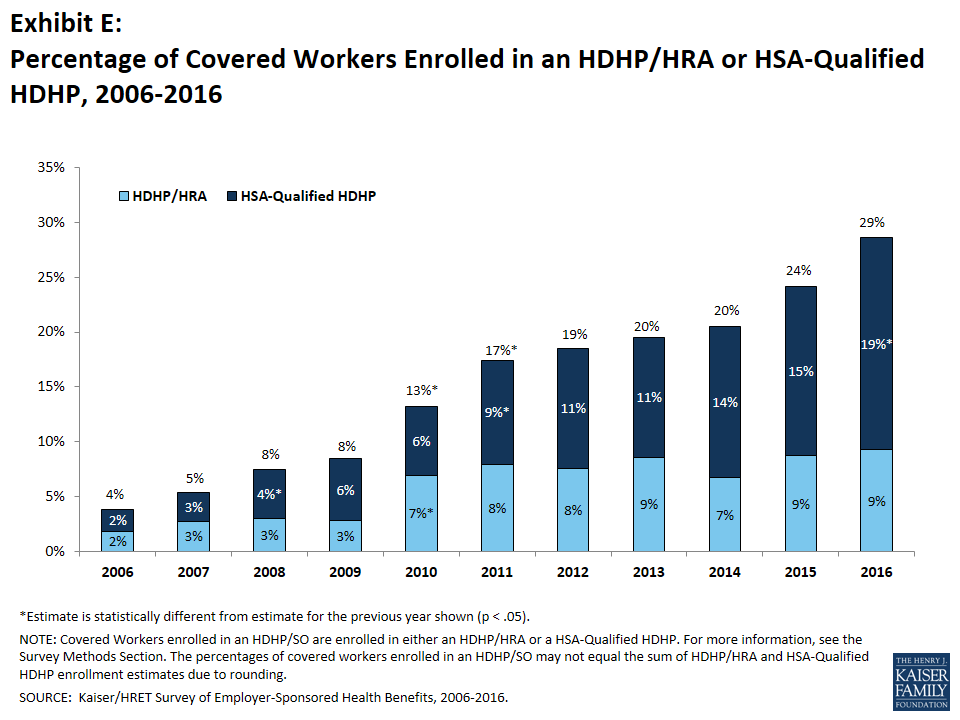

The number of covered workers with HDHPs has grown 8% over the last two years. This change in enrollment has reduced the growth in single and family premiums by roughly a half percent each of the last two years, according to the Kaiser Family Foundation/Health Research & Education Trust 2016 Employer Health Benefits Survey.

More enrollment in HDHPs impacts employer health costs and options:

- The lower premiums mean employers are paying less towards their employees’ health plans.

- The ability to pair HDHPs with HSAs, allows employers to get creative with their health care solutions. For example, employers can opt to contribute to HRAs and HSAs in order to offset some of the impact of the employee’s out of pocket expenses.

- HSAs produce a different kind of health care consumer environment. It empowers employees and employers to be conscious and proactive consumers of their healthcare costs and options.

Do you have a benefits question?

Ask our Benefits Expert!

Tandem HR is an IRS certified professional employer organization (CPEO) providing custom HR solutions to hundreds of small and mid-sized businesses.